Intraday Price-Action Playbook

Turn noisy sessions into repeatable trades. This no-fluff playbook fuses Price Action, ICT, and SMC into clear, step-by-step frameworks you can execute the same day across FX, indices, crypto, metals, and futures—without cluttered indicators or guesswork.

What you’ll master

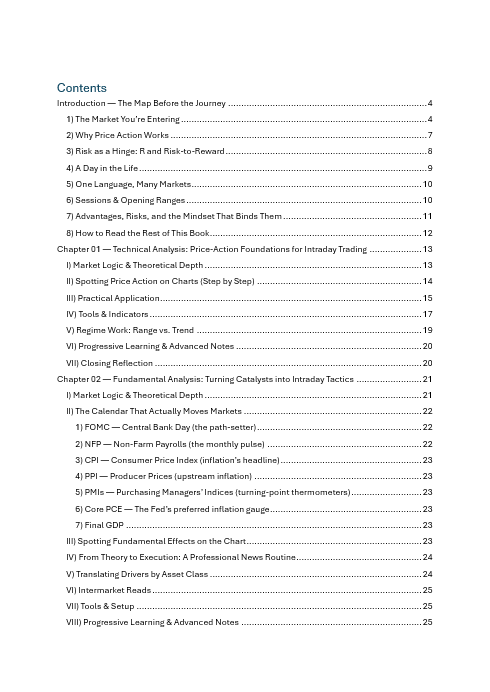

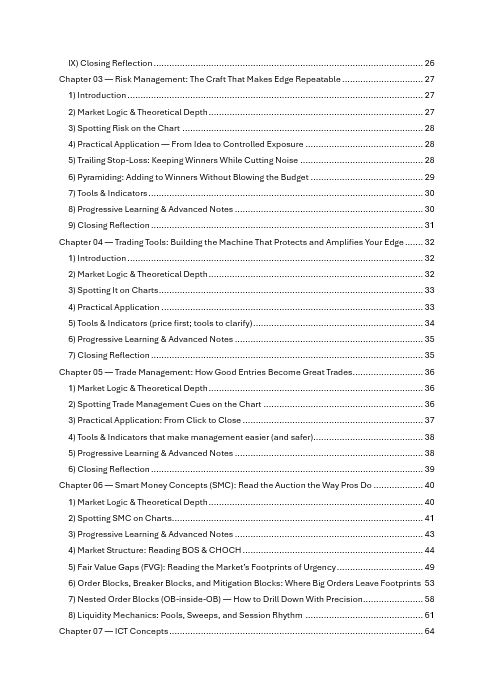

- 5 core intraday setups with precise entry/exit rules: liquidity sweep reversal, order-block retest, displacement/FVG continuation, breakout-retest, and trend pullback to CE (50% of imbalance).

- ICT/SMC essentials—made practical: BOS vs CHOCH, displacement, FVGs, order blocks/breakers/mitigations, inducement, premium/discount, and session “kill-zones.”

- Risk model that scales: fixed-R sizing, volatility-aware stops, partials, pyramiding under a heat cap, and realistic daily loss brakes.

- Checklists & routines: pre-market bias → execution → post-market review, plus journaling prompts that turn screenshots into improvements.

- Annotated examples: real charts that show exactly where the raid happened, what proved intent, and where the retest paid.

Built for traders who want…

- Clarity on timing. Know when to expect the raid, what proves the shift, and where the retest should hold.

- Tight, logical risk. Stops at premise failure, not at a random number—so you risk small and let winners run.

- A repeatable day plan. Same questions, same windows, fewer forced trades.

Inside the playbook

- Session framework: Asia → London → New York rhythm, opening-range edges, and how to read reject vs accept.

- Location over prediction: trade from levels with narrative weight—prior highs/lows, equal highs/lows, OB/FVG footprints.

- Execution tactics: limit vs stop-limit, spread/slippage filters, time-stops, and two trailing styles (structure + ATR).

- Progress plan: beginner → intermediate → advanced paths with 20-trade drills so you build skill on purpose.

Why it works

You’ll stop chasing impulse candles and start waiting for a sequence:

Raid → Displacement → Return → Continuation, sized in R and aimed at real liquidity. The result is fewer trades, cleaner timing, and a smoother equity curve.

Format: concise explanations, diagrams/annotated charts, checklists, and quick-reference pages

Skill level: ambitious beginners to advanced intraday traders

Markets: FX, indices, crypto, metals, energy futures

Note: Educational content only. No signals, no financial advice.

Ready to turn randomness into a routine? Get the playbook and trade with intent.

Reviews

There are no reviews yet.